Some Of Retirement Planning

Wiki Article

Little Known Questions About Retirement Planning.

Table of ContentsHow Retirement Planning can Save You Time, Stress, and Money.Rumored Buzz on Retirement PlanningThe Definitive Guide to Retirement PlanningNot known Details About Retirement Planning

There is also a particular benefit of sensation monetarily protected that aids people make far better decisions in the existing minute. If you don't think it, just think of just how you may really feel if you were heavily in financial debt (especially credit history card financial debt). Equally as being caught under the worry of punitive interest settlements makes it tough to assume and prepare clearly, but having a substantial nest egg for the future will certainly really feel like a breath of fresh air throughout your functioning years.

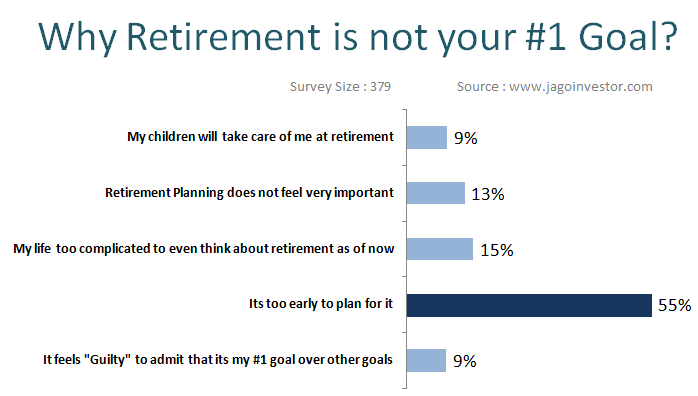

There's no shame in relying upon relative when you really need them. Nevertheless, in America there is an entire range of opinions on proper borders with expanded member of the family and in-laws. You can not (or must not) anticipate to depend on your kids to take treatment of you monetarily or in reality.

It's vital to remember that by the time you retire, your youngsters might have youngsters of their very own that they require to sustain, which indicates that if they additionally require to support you, you're putting them right into something popularly called the Sandwich Generationa team "sandwiched" in between the economic duty of looking after their youngsters and taking care of their parents.

How Retirement Planning can Save You Time, Stress, and Money.

With a retired life plan in area, you'll have even more cash to offer as you prepare yourself to leave a tradition. Having a retirement in position might not be the important things that fixes your marital relationship, but it can absolutely help. As you could presume, national politics, intimacy, youngster rearing, and cash are among the biggest provocateurs of arguments in a couple.Do not place the monetary security of your gold years off any longertimetable a free appointment with an Anderson expert today! - retirement planning.

Below are some of the main reasons retirement planning is important. Additionally read: 10 Creative Ways to Generate Income After Retired Life Inflation is driving the price of living to this content brand-new heights; today's monthly budget plan will not suffice to cover your weekly budget in 25 or 30 years when you retire.

The investments must be long-term and fairly low-risk that can stand up to economic downturns, like realty and federal government bonds. Find out more >> Increasing Inflation: Where Should You Keep, Invest Your Money? While most employees like to work till they struck the obligatory retirement age of 60, in some cases, these plans can be interrupted.

Retirement Planning Things To Know Before You Get This

You can rollover that expertise to other locations of life. For instance, you can duplicate your effective retirement financial investment methods in your various other investing objectives, such as acquiring a home. It will certainly help you develop riches and also retire abundant. Planning for retirement will help prepare your estate to align with your life heritage.

You can preserve your wealth and leave it to your dependents, who you trust will certainly proceed your tradition. Investing in realty and also obtaining life insurance policy can leave your dependents monetarily set after you are gone. Likewise check out: What to Do If You Lose Your my review here Revenue Mid-Career? After retiring, the very best thing you can do for your household is not worry them monetarily.

You need to be the person aiding your kids spend for your grandkid's education and learning and such. Relying on your kids monetarily after retirement as well as having them pay "black tax" can dramatically hinder their monetary development, producing a generational destitution circle. Even even worse, it can add to disunity in the household. retirement planning. Retired life planning will certainly help you produce safeguard from where you will certainly be generating earnings after retired life to support yourself as well as not worry others with your financial requirements.

Without sufficient prep work and also monetary planning, it can feel like jail. You will have click this a great deal of spare time, and without strong financial muscles, there is only little you can do. Planning for retirement can help you manage to achieve points and also attain desires you could not while functioning. One of the most adventurous hobbies retirees like to tackle is travelling (retirement planning).

Retirement Planning Fundamentals Explained

Report this wiki page